Cyprus invoice requirements

A common question by new Cypriot companies is what information should be included in an invoice – particularly an invoice with VAT.

The EU has agreed a single set of basic EU-wide invoicing rules (Articles 217-240 of the VAT Directive). As a general rule, our advice to businesses is to follow these EU minimum requirements when issuing invoices.

You can find summary guidance by the EU on what information should be included in invoices, available on this link.

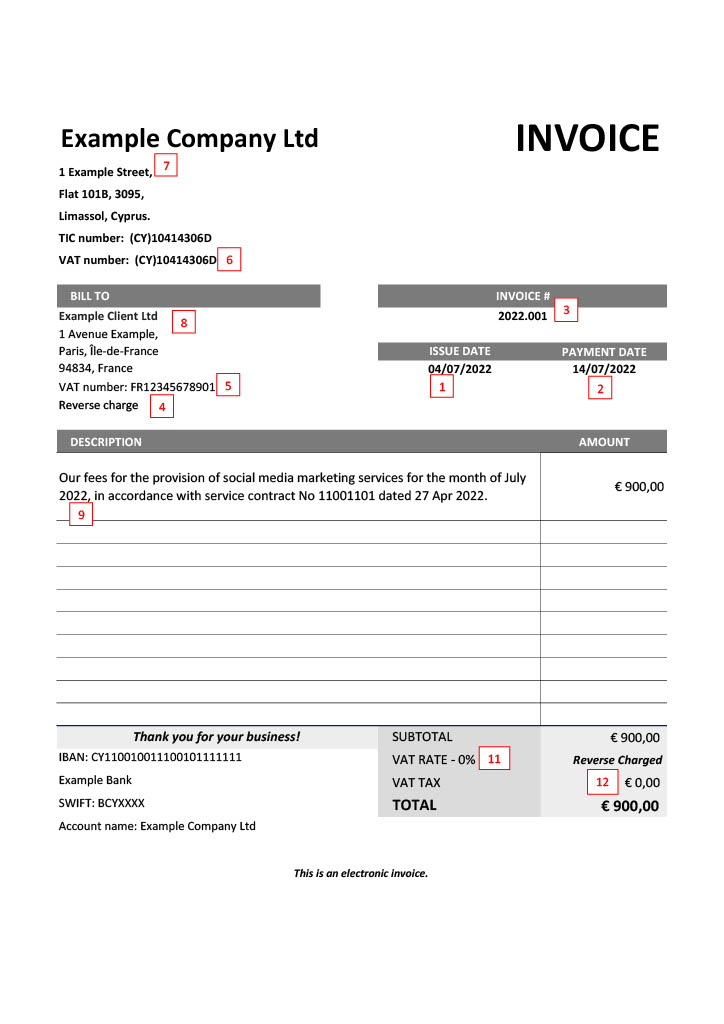

Indicatively, invoices of Cyprus companies should contain all of the below information:

- Date of issue

- Date of transaction or payment (only if different from invoice date)

- Unique sequential invoice number

- Customer liable for the tax (i.e. under the reverse-charge procedure) – the words ‘Reverse charge’

- Customer’s VAT number (if reverse charge applies)

- Supplier’s VAT number

- Supplier’s full name & address

- Customer’s full name & address

- Detailed description of quantity/type of goods supplied, OR detailed description of type/extent of services supplied

- Unit price of goods or services – exclusive of tax, discounts or rebates (unless included in the unit price)

- VAT rate applied

- VAT amount payable (a separate item, on a separate row)

- Breakdown of VAT amount payable by VAT rate or exemption

Invoice example:

Common mistakes:

Confusing/haphazard invoice numbers

Although there is no single ‘correct’ coding system which must be used in all cases, the best practice (in the event of a tax review) is to follow a numbering sequence which easily demonstrates the completeness of all your invoices.

For example: INV.2022.001, INV.2022.002, INV.2022.003, etc.

Using US templates

Invoice templates designed for US companies frequently omit the word ‘VAT’ (often replaced with ‘tax’) and in some cases even ignore VAT altogether. VAT rate, and VAT amount should always be identified and stated separately from the gross total amount on your invoices.

Counterparty VAT number

To be able to sell with 0% VAT (reverse charge) it is necessary to print on the invoice the validated VAT number of your counterparty. You can find more information on VAT in our comprehensive VAT guide.

Additional requirements

The above list outlines the basic minimum required under EU laws. In special cases (for example if a margin scheme is applied, if a supplier operates cash accounting, etc) there are additional requirements as to what information should be included on the invoice.

If you are unsure what information to include in your invoices, please contact our team for professional guidance.